The University of Chicago’s Richard Thaler has been awarded this year’s Nobel Prize in economics. Thaler is a leading practitioner of behavioral economics, the application of psychology to problems of valuation, choice, exchange, and pricing. Following Mises, most Austrian economists have distinguished sharply between praxeology, the logical analysis of action, and psychology, the behavioral motivations and affects that precede and follow action (1, 2). (For example, Austrians say human action is purposeful, meaning goal-oriented, not rational, meaning successful at achieving its goals.) Neoclassical economics, however, has gone the other way, with an increased tendency to blend the two, hoping to come up with a richer and more robust explanation of human behavior. After all, if people are modeled as “maximizing their utility,” and utility is understood as a psychological state of well-being, then why not introduce psychology into the analysis?

Carl Menger’s theory of valuation and choice, as developed in the works of Böhm-Bawerk, Fetter, Wicksteed, Mises, Rothbard, and other Austrian economists, is a logical, not a behavioral concept, and most of the alleged “paradoxes” identified by behavioral economists don’t apply. (Here’s one, slightly technical example.) Thaler remarked today: “In order to do good economics you have to keep in mind that people are human” — i.e., human actors are not the super-calculating machines embodied in neoclassical models. Indeed, they aren’t. But adding psychology to the apparatus of neoclassical choice theory may not be an improvement. Of course, an understanding of psychology is important for entrepreneurs, historians, and applied economists. But economic theory, as understood by Mises, is a logical exercise independent of the particular psychological motivations of the actors.

Aside from his more technical contributions Thaler is a great popularizer of behavioral economics, especially through his collaborations with Cass Sunstein. Thaler and Sunstein argue that because people behave “irrationally” (i.e., in ways that do not maximize their utility, as understood by neoclassical economics), governments may intervene — not by banning or mandating particular behaviors — but by “nudging” people, gently, in the right direction. (E.g., laws could mandate that supermarkets put healthy food toward the front of the store, that employers automatically enroll employees in retirement savings accounts unless they specifically opt out, and so on.) Thaler and Sunstein even call this “libertarian paternalism,” to distinguish it from the more heavy-handed varieties of governmental intervention.

David Gordon has reviewed their very popular book Nudge and — as you might expect — identifies a number of serious problems with the book. (See also here, here, and here.) One obvious problem is that the actors who design and implement the behavioral nudges are themselves “irrational,” like all human actors, so why would we expect the nudges to improve social outcomes? (Mario Rizzo and Glen Whitman cleverly call this “The Knowledge Problem of the New Paternalism.”) I have argued that, more generally, behavioral economics often repackages simple ideas well-known to applied economists, businesspeople, historians, and so on and treats them as novel and exciting laboratory findings. A fascinating 2014 essay by Steven Poole points out that most of these findings don’t apply to the real world because, among other things, people behave in particular ways in the laboratory, ways that are actually quite “rational.” (Even some neoclassical economists remain unconvinced.)

On the whole, Austrian economists can be glad that Thaler’s Nobel Prize opens the door for conversations about the basic ideas of valuation, choice, and exchange and how we should try to understand human behavior. It’s all the more important to remind people that praxeology offers a parallel, but distinct, critique of neoclassical microeconomics.

–

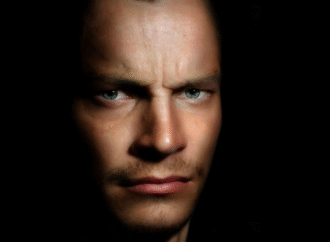

Peter G. Klein is Carl Menger Research Fellow of the Mises Institute and W. W. Caruth Chair and Professor of Entrepreneurship at Baylor University’s Hankamer School of Business.

This Mises Institute article was republished with permission.

Leave a Comment

Your email address will not be published. Required fields are marked with *