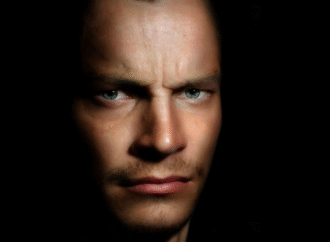

Think before you speak. This is the first lesson political advisors teach rookie politicians.

Unfortunately, President Trump has always turned a deaf ear to the advice of those around him. Trump never refrains from expressing his views openly (especially on Twitter,) no matter the impact his words may have on the economy.

Trump’s verbal incontinence recently led J.P. Morgan to build the so-called Volfefe Index (named after Trump’s strange covfefe tweet) to measure the effect of the President’s tweets on financial markets.

Specifically, this index examines how Trump’s tweets, especially those related to trade policy, affect the U.S. Treasury’s implied volatility. According to J.P. Morgan, a “measurable fraction” of the moves in implied volatility since early 2018 can be explained by Trump’s tweeting activity. What does this mean?

Implied volatility is an (imperfect) measure of uncertainty. Increasing asset volatility is thus a sign that economic uncertainty is going up, a bad thing for economic growth. If consumers and businesses perceive that economic prospects are uncertain, they will delay their consumption and investment decisions indefinitely, dealing a significant blow to the economy.

Unsurprisingly, it’s Trump’s tweets on trade policy that are causing implied volatility to increase. The latest U.S. Purchasing Managers’ Index, which reflects the optimism of managers regarding the future of the economy, seems to confirm this: it fell to 49.1 percent in August, the lowest level in three years. Can mere tweets really have such a negative influence on the economy?

They shouldn’t. The problem with Trump’s tweets is that they are a reflection of the Trump administration’s trade policy. In fact, numbers suggest that the trade war initiated in 2018 is already wreaking havoc on the U.S. economy.

According to a recent paper published by the National Bureau of Economic Research, the trade war has resulted in higher domestic prices due to tariffs being passed onto consumers, less variety of imported products, and costly adjustments for businesses to create new supply-chain networks. The authors quantify the losses in terms of real income in $1.4 billion per month.

In addition, the trade war has failed to reduce the U.S. trade deficit, one of the (unfounded) obsessions of President Trump. Could this be due to retaliatory tariffs negatively affecting American exporters? Perhaps importers and consumers aren’t the only victims of protectionism.

If President Trump doesn’t want to do away with his trade policy, perhaps he should consider ceasing his use of Twitter. The economy, at least, might appreciate it.

—

[Image Credit: Flickr-The White House, public domain]

Leave a Comment

Your email address will not be published. Required fields are marked with *